Is Office Supplies Expense . Web office supplies are usually considered an expense. But things can get tricky when dealing with office supplies,. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Office supplies include such items as paper, toner cartridges, and writing instruments. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. As a matter of fact, it. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check. Web office supplies are expenses that are incurred during the course of operations within the company.

from www.myaccountingcourse.com

Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. But things can get tricky when dealing with office supplies,. Web office supplies are usually considered an expense. Office supplies include such items as paper, toner cartridges, and writing instruments. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. Web office supplies are expenses that are incurred during the course of operations within the company. As a matter of fact, it.

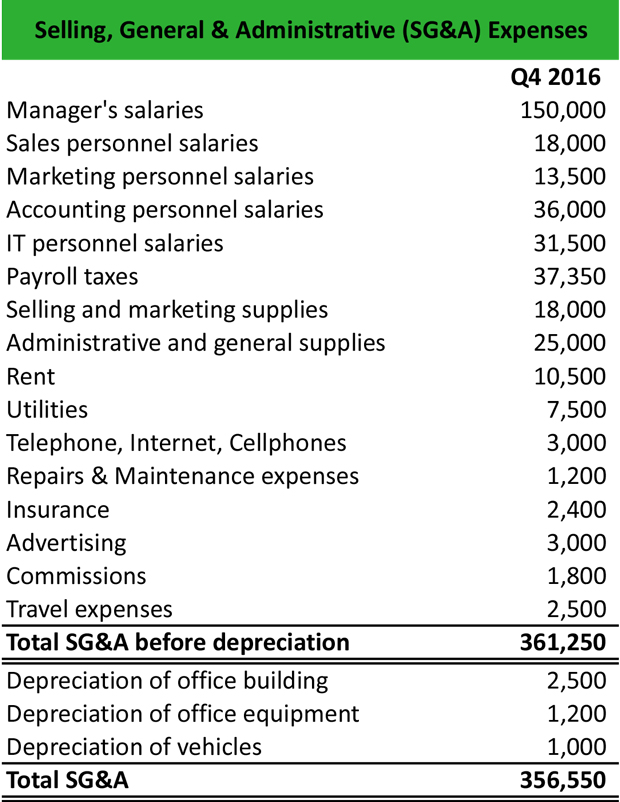

What is Selling, General & Administrative Expense (SG&A)? Definition

Is Office Supplies Expense Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. But things can get tricky when dealing with office supplies,. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check. Office supplies include such items as paper, toner cartridges, and writing instruments. Web office supplies are expenses that are incurred during the course of operations within the company. As a matter of fact, it. Web office supplies are usually considered an expense. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account.

From info.primepac.co.nz

Is coffee an expense or office supply? Is Office Supplies Expense As a matter of fact, it. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check. But things can get tricky when dealing with office supplies,.. Is Office Supplies Expense.

From www.pinterest.com

office supply budget template office supply budget template business Is Office Supplies Expense Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. As a matter. Is Office Supplies Expense.

From thebottomlinegroup.com

Office Supplies Expense The Bottom Line Group Is Office Supplies Expense Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. As a matter of fact, it. Web office supplies are expenses that are incurred during the course of operations within the company. But things can get tricky when dealing with office supplies,. Web office supplies are usually considered an. Is Office Supplies Expense.

From old.sermitsiaq.ag

Expense Form Templates Is Office Supplies Expense But things can get tricky when dealing with office supplies,. Web office supplies are usually considered an expense. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. As a matter of. Is Office Supplies Expense.

From www.akounto.com

Are Supplies an Asset? Understand with Examples Akounto Is Office Supplies Expense Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check. Web office supplies are usually considered an expense. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. As a matter of fact, it. Office supplies. Is Office Supplies Expense.

From brainly.ph

CHART OF ACCOUNTS ASSET 101Cash 102Prepaid Rent 105Office Supplies Is Office Supplies Expense As a matter of fact, it. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. Web office supplies are expenses that are incurred during the course of operations within. Is Office Supplies Expense.

From cashier.mijndomein.nl

Office Supplies List Template Is Office Supplies Expense As a matter of fact, it. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web office supplies expense is the amount of administrative supplies charged to expense in. Is Office Supplies Expense.

From www.etsy.com

Office Supplies Request Printable Form Business Expense Etsy Is Office Supplies Expense Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Office supplies include such items as paper, toner cartridges, and writing instruments. Web office supplies are usually considered an expense. As a matter of fact, it. But things can get tricky when dealing with office supplies,. Web the cost of the. Is Office Supplies Expense.

From instreamllc.com

The Cost of Outdated Office Supplies Why Go Paperless Is Office Supplies Expense Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web office supplies are expenses that are incurred during the course of operations within the company. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web the cost of the office supplies used. Is Office Supplies Expense.

From www.ehow.com

How to Reduce Office Supply Expenses Bizfluent Is Office Supplies Expense Office supplies include such items as paper, toner cartridges, and writing instruments. As a matter of fact, it. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. Web keep reading to. Is Office Supplies Expense.

From excelxo.com

office supply expense report template — Is Office Supplies Expense As a matter of fact, it. Web office supplies are expenses that are incurred during the course of operations within the company. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web the cost of the office supplies used up during the accounting period should be recorded in the income. Is Office Supplies Expense.

From www.etsy.com

Office Supplies Request Printable Form Business Expense Etsy Is Office Supplies Expense Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Office supplies include such items as paper, toner cartridges, and writing instruments. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check. Web the cost of the office supplies used. Is Office Supplies Expense.

From www.superfastcpa.com

What is Office Supplies Expense? Is Office Supplies Expense Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. As a matter of fact, it. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check. Web the cost of the office supplies used up during the accounting period should. Is Office Supplies Expense.

From www.excelstemplates.com

Office Supply Inventory Templates 11+ Free Xlsx, Docs & PDF Formats Is Office Supplies Expense Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web office supplies are expenses that are incurred during the course of operations within the company. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Office supplies include such items as paper, toner. Is Office Supplies Expense.

From finmodelslab.com

Unlock Cost Savings Mastering Office Supplies Expenses Is Office Supplies Expense Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web. Is Office Supplies Expense.

From animalia-life.club

Office Supplies List Template Is Office Supplies Expense Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check. Web the cost of the office supplies used up during the accounting period should be recorded in the. Is Office Supplies Expense.

From www.ccalcalanorte.com

Small Business Expense Sheet Templates CC Alcala Norte Is Office Supplies Expense Web the cost of the office supplies used up during the accounting period should be recorded in the income statement account. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an. Is Office Supplies Expense.

From www.smartsheet.com

Free Small Business Expense Report Templates Smartsheet Is Office Supplies Expense But things can get tricky when dealing with office supplies,. Web office supplies are expenses that are incurred during the course of operations within the company. As a matter of fact, it. Office supplies include such items as paper, toner cartridges, and writing instruments. Web keep reading to learn why it pays for small business owners to understand deductions (even. Is Office Supplies Expense.